Many expat workers in the kingdom want to know how much they should pay for the expat levy which took effect in July 2017.

This personal tax is levied at all family member dependents and paid for by foreign employees living and working in the commercial and private companies in the kingdom.

So, what exactly does the expat levy cost? The fee has grown incrementally from 2017 until 2020. The personal fees beginning in July are as follows and are payable for each dependent per month.

- 2017- 100 SR

- 2018 -200 SR

- 2019 -300 SR

- 2020 -400 SR

This levy was introduced in 2016 by the Saudi Ministry of Economic Planning, the Ministry of Finance, the Cabinet and Council of Ministers with a twofold aim.

First, it is to generate much needed non-oil revenue. Second, it aims to deter expats and encourage companies to hire Saudi nationals.

Who is Exempted from the Levy?

- Wives of Saudi nationals

- Sons/Daughters of Saudi mothers

- Widowed wives of Saudi Nationals

- Divorced wives of Saudi Nationals

- Abandoned Expat Dependents registered on the “Left and did not return” system.

- Dependents of foreign workers with the Saudi government ministries and departments.

- Foreign students sponsored by Saudi universities.

- Foreign Nationals not traveling outside Saudi Arabia for 40 years or more.

- Expat Government employees

Calculating and How to Pay the Fee

Expat Fees are calculated and are to be paid when the foreign worker renews his/her residency permit.

The calculation will include the fee, the number of your dependents, your Residency Permit (Iqama) renewal/expiry date.

Be sure that you know the expiry date. To know this at the Abshir website, go to Dashboard, then Details and Residency Information to find out exactly when your ‘Iqama’ expires.

- For July 1st, 2018 to 2019, calculate 200 SR x number of dependents.

- From July 1st, 2019 to 2020, calculate 300 SR x number of dependents

- From July 1st, 2020 onward, calculate 400 SR x number of dependents

The handy table below shows the annual amount payable for the total number of dependents for 2018, 2019 & 2020 in Saudi Riyals.

Dependents include a wife and/or additional family members; sons & daughters under 18, parents, in-laws and sponsored domestic laborers.

The Saudi Directorate of Passports (GDP)

“The fees should be paid in advance and on a yearly basis along with the issuing or renewal of the worker’s residency permit when issuing exit-re-entry visa or even final exit visas.”

| No | 2018 | 2019 | 2020 |

| 1 | 2,400 | 3,600 | 4,800 |

| 2 | 4,800 | 7,200 | 9,600 |

| 3 | 7,200 | 10,800 | 14,400 |

| 4 | 9,600 | 14,400 | 19,200 |

| 5 | 12,000 | 18,000 | 24,000 |

| 6 | 14,400 | 21,600 | 28,800 |

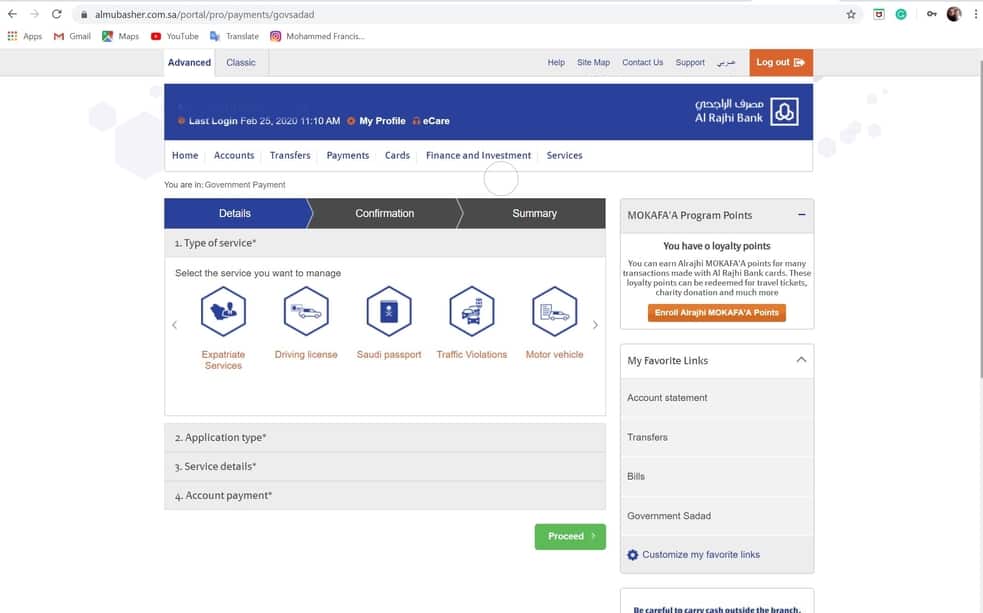

You can pay the dependent fees in much the same way you pay for your electricity, phone and water bill from your online bank account using the SADAD facility, the Saudi national electronics payment system

- Log into your bank account

- Open SADAD, then click Government Payments

- Select MOI Service, then click Alien Control

- For Transaction Type choose Payment

- For Service Type -Choose Associate Fee for Head of Household

- For Iqama ID– Type in ‘Iqama number of Head of Household

- For Fees Duration enter the ‘Iqama’ expiry date (MFS)

- Then press Request

- The Total Amount to pay will then be displayed.

Expat Business Levy

Also, starting in January 2017, an additional tax is now levied on companies hiring foreign workers and the amount is for each expat worker in the company.

The table below shows the charges and the higher amount shown are for companies that have more expat workers than Saudis.

It is to be paid for by the employee themselves though the company may voluntarily foot the bill.

For companies with expat staff equal to or not exceeding the number of Saudi employees, the lower amount (below) is charged per month. The fee, however, cannot be waived.

The company fees beginning in January are as follows.

- 2018- 300 SR or 400 SR

- 2019 – 500 SR or 600 SR

- 2020 – 700 SR or 800 SR

Why Expat Levies Anyway?

Saudi Arabia wishes to generate 65 billion SR in expat fees before 2020. But experts at the Riyadh Chamber of Commerce have warned that while taxes are good for the economy in general, taxing companies so dependent on foreign labor is bound to have a detrimental effect.

It is putting a huge strain on companies employing expats and the foreign workers themselves.

The fees are impacting contractor operations, material supplies, and the prices of food and consumer products have risen.

Also, savings will decline in real terms between 6-15%. Saudi Arabia is becoming less attractive as a market to do business in.

The Jeddah Chamber of Commerce (JCCI) sent a report to the Ministry of Labour and Development (MLSD) outlining the strong opposition to the tax; 95% of private sector companies and demanding more time, even postponement of the decision.

What Has Been the Impact of the Expat Levies?

Firstly, many low income and middle-income workers have been badly hit by the levies and cannot afford to pay. Thousands have sent their families back home and continued working in the kingdom on a bachelor status. The most affected nationals are Asians from India, Pakistan, Sri Lanka, Philippines, Bangladesh and Nepal.

Secondly, The Jeddah Chamber of Commerce (JCCI) predicts that between 25% to 30% of all private businesses may shut down due to the loss of skilled expat labor.

Currently, 15.6% of business establishments in Jeddah are on the verge of collapse and 11% are facing financial hardships. (MFS) Thirdly, the departure of foreign workers and their families has negatively impacted the economy. Businesses are under strain.

Also, rents in most Saudi towns and cities have plummeted and the streets are full of advertising signs for rent of vacant apartments and shops. Fourthly, private businesses have been forced to close due to higher costs and lower sales.

For example, many rental car companies cannot pay the high salaries demanded by Saudis and nor meet the operational costs of running vehicles and so have closed down. Fifthly, it is estimated that about 30% of private schools have been affected and that some a set to close down.

Student numbers have fallen since foreign expats have sent their children to resume studies in their home countries. Fewer students mean fewer fees and in turn caused budget restraints. Sixth, by 2019 more than 800,000 foreign workers per year are returning to their home countries. ironically, employment figures for Saudis have actually risen by 13%.

Ways to Avoid Paying the Expat Dependent Fee

As long as you are a foreign worker in employment and living with your family you cannot avoid paying the dependents fee. However, some ways have been suggested that will help take the sting out of it.

- Get a government job. Currently, expat workers employed in Saudi government position are exempted from paying the levy.

- Share housing. Since thousands of expats have already left Saudi Arabia there is an abundance of rental properties available.

- Today in order to save money, families can find much better deals and can share their properties with other families thus reducing monthly rental payments.

- Start a part-time business. There are informal opportunities that can be done from home both off and online. (MFS)

Related Questions

Are all companies required to pay the Business Expat levy? Yes, all private companies on nongovernment contracts must pay the business tax levy for all employees EXCEPT small companies with five or fewer foreign workers.

The levy must only be paid for every worker above the number of five employed in the company.

Are private companies engaged in government-contracts exempt from paying the expat levy? Yes and No! If private contract companies began work before December 2016 and the same work is due to finish after 2018, then no tax is due on them.

However, new contracts between private and Saudi government projects will be subject to expat levy charges.

Will the expat levy be ever be abolished or revised? Saudi Arabia does not plan to revise the expat fee any time soon. In fact…..

Mohammed Al Jaddan

“There are no plans to revise any of the reforms that we have implemented. These have been modeled for an extended period of time. We knew what the impact was going to be.”

Finance Minister of Saudi Arabia (Aug 2018)