I was a bit shocked when back in 2017 Saudi Arabia announced it would impose 5% Value Added Tax (VAT) on goods and services beginning 1st January 2018.

I was further surprised when on 1st July 2020, VAT charges rose to 15%.

But, taxes here are nothing new. Whilst there has been no governmental tax, people in the kingdom have been paying voluntary taxes for centuries called ‘Zakat‘ (money and food) intended to help the poor and needy.

VAT, however, is the first obligatory tax the kingdom has ever imposed.

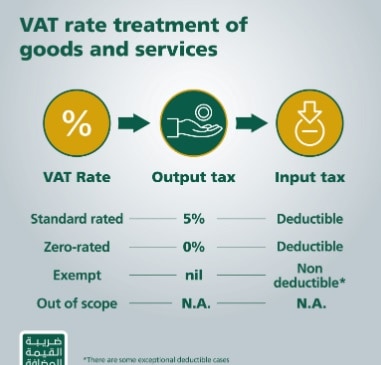

What is VAT in Saudi Arabia? In a nutshell, VAT in Saudi Arabia is an indirect tax to be paid on selected goods and services by consumers.

When a VAT registered business in the kingdom sells a product or service in a shop or outlet, it now charges 15% in VAT which consumers must pay.

After customers pay 15% VAT on top of the sales price of goods they buy, the business must then account for the VAT separately and later remit it to the government. This is called Output VAT.

In turn, this same VAT registered business must also pay 15% VAT to its suppliers (also VAT registered) for the same goods it will later sell to consumers. This is called ‘Input VAT’.

The VAT collected from consumers by the business will then be subtracted from the total amount of VAT which is paid to suppliers and the amount owed to the government will then be calculated.

‘Output VAT’ – ‘Input VAT’ = VAT Due

How Does Saudi VAT Compare With Other Countries?

| Saudi Arabia | 15% |

| UK | 20% |

| Europe | 19-22% |

| Morocco | 20% |

| Sudan | 18% |

| Turkey | 18% |

| Bangladesh | 15% |

| India | 12-15% |

| Egypt | 13% |

| Philippines | 12% |

| Lebanon | 10-11% |

| Indonesia | 10% |

Who collects VAT in Saudi Arabia?

There is an organisation in Saudi Arabia called the General Authority of Zakat and Tax or (GAZT). It organizes tax collections, deals with registrations, refunds, audits and penalties.

How does VAT tax collection work?

Simply speaking, every time a company and/or an individual makes a purchase, that purchase is subject to an additional charge of 15% in VAT which should be paid to the government at the end of the taxable period.

So take the simple example of milk. First, the cow makes it. The cow doesn’t charge for her milk. Then, the dairy sells the milk to a distributor.

This distributor takes the milk for a price but also must pay an additional 15% VAT to the dairy (Input VAT ) who then separately declares that extra 15% VAT to the government. (Output VAT)

Soon after, the distributor takes the milk and then sells it to the supermarket. The supermarket is also charged an additional 15% VAT on the price it pays for the milk (Input VAT) which the distributor, in turn, declares to the government. (Output VAT)

The table below illustrates how a milk distributor calculates the VAT owed.

| VAT Transaction | Price per Unit | Tax per Unit | Units Bought | Total Tax | Tax Name |

| The Dairy collects Milk from Cows | SR 2 | 15% | 10,000 (Sold) | SR 3000 | 1. Output VAT |

| The Distributor buys Milk from the Dairy | SR 2 | 15% | 10,000 | SR 4500 | 2. Input VAT |

| Distributor sells Milk to Supermarket | SR 4 | 15% | 10,000 | SR 6000 | 3. Output VAT |

| VAT Distributor owes= (3. Output VAT –2. Input VAT) | SR 4,500-SR 10,500 =SR 5,500 |

Finally, on the day we shop for fresh milk in the supermarket, we too pay for the milk together with a 15% VAT on the price to the supermarket who also submits this 15% to the government in the same way. (Output VAT)

| VAT Transaction | Price per Unit | Tax per Unit | Units Bought | Total Tax | Tax Name |

| The Supermarket Buys Milk from the Distributor | SR 4 | 15% | 10,000 | SR 6000 | Input VAT |

| The Supermarket sells Milk to the Customer | SR 8 | 15% | 10,000 | SR 12,000 | Output VAT |

| VAT Supermarket owes = (Output Vat -Input Vat) | SR 10,00-SR 12,000 =SR 6,000 |

The customer pays only Input VAT for the milk and cannot be liable for Output VAT since he/she is a consumer of the product and not a VAT registered entity.

In this chain of buying and selling, every one (1) the dairy, (2) the distributor, (3) the supermarket and (4) the customer all pay 15% VAT on their purchases which the government seeks to collect.

They all (except the consumer) pay the government the difference in the 5% VAT between the cost of their purchases Input VAT and the cost of their sales Output VAT in the buying and selling process as illustrated above in the tables.

In this way, prices for goods and services are not really affected.

It is simply that transactions in the chain of supply ending with the consumer are both taxed at 15% and the difference between the amount of tax charged on the goods that were bought and those that are eventually sold is paid to the government.

In the end, it is only the customer who fully pays the 15% VAT on the items they consume.

The businesses involved in buying and selling the goods and services the customer buys are reimbursed and not left out of pocket.

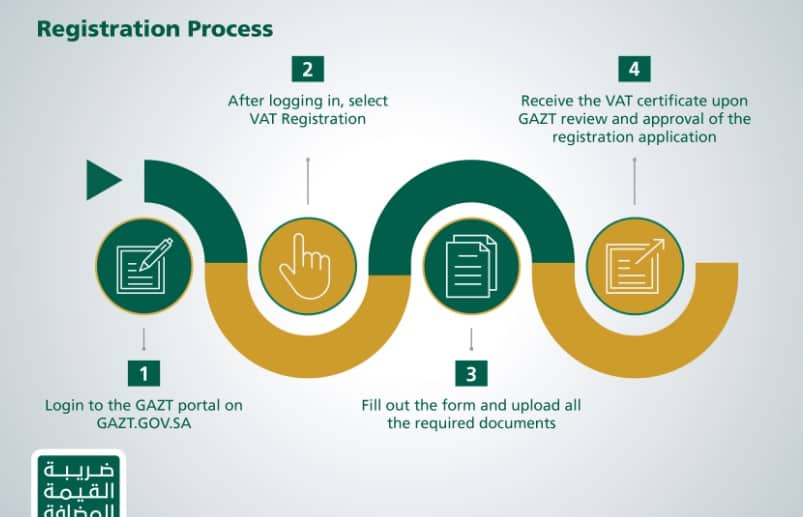

How businesses register in Saudi Arabia.

Businesses operating in Saudi Arabia must first register at the GAZT portal. The following information must be entered.

- Tax Identification Number (TIN)

- Business details, IBAN & revenue thresholds

- Projected/Actual Sales for next and last year

- Projected/Actual Expenses for next and actual year

- Tax Agent Details if Non-Saudi Business Owner

- VAT Group Registration (if applicable)

Who pays 5% VAT?

There are two groups who pay 5% VAT.

| Group 1 -Businesses with | |

| taxable sales of SR 375,00 or more (2017) | Required |

| taxable sales of SR 1,000,000 or more (2018) | Required |

| Group 2- Businesses with | |

| taxable sales of SR 187-375,000 | Optional |

| taxable sales above SR 375,000 ‘zero-rated’ | Optional |

Who is exempt from paying VAT?

Exempted goods and services are not subject to VAT. Businesses cannot collect VAT from suppliers and deductions cannot be made for the following:

| Exempted Goods |

| 1. Financial Services |

| 2. Real Estate- Residential lease or Rentals |

| 3. Imported Goods for diplomatic or military use |

| 4. Imported personal/household items |

| 5. Imported returned goods |

What are Zero-rated Goods?

Zero-rated goods are taxable but charged at 0% VAT. This is so businesses selling zero-rated goods can still deduct their input VAT and reclaim funds.

Businesses selling only exempted goods cannot get funds reimbursed.

Zero-rated goods apply to the following areas:

| 1. Exports to Non-GCC countries |

| 2. Exports to GCC countries (temporary) |

| 3. International Transport and Machinery |

| 4. Qualifying Medical Goods (MoH Approved) |

| 5. Investment Metals – Gold, Silver and Platinum of 99% purity |

Consider again our example of milk. A Saudi distributor sells and exports milk products to companies outside the GCC. For those items, no Output VAT is due because they are zero-rated.

However, this distributor still has to pay Input VAT in the Saudi kingdom to the dairy to purchase the goods before they are exported.

GAZT will reimburse the distributor 15% VAT for the portion he has paid in Input VAT on milk products which are sold abroad.

The distributor gets refunded since he/she originally pays input VAT on the milk products from the dairy but none is paid back to him/her in zero-rated exports.

Here the amount of Input VAT exceeds Output VAT so the difference is reimbursed.

The same is also true for Saudi companies like airlines that offer both domestic and international flight services.

The domestic goods and services are liable for the standard 5% VAT but the international portion of the business is eligible for zero (0%) rated VAT.

For example, Saudi Airlines buys an airplane for SR 350 million. For this it must pay SR 17.5 million in VAT. (Input VAT). Later, it sells tickets both domestic and international.

For the domestic sales, it charges customers standard 5% VAT AND for international customers, it charges 0% VAT. (Output VAT).

The VAT due is calculated as (‘Output VAT’ – ‘Input VAT‘ = the VAT due).

Output VAT here is the 15% taxable sales of domestic flights AND the zero-rated 0% sales of international tickets minus the Input VAT SR 17.5 million for a new plane.

Determining Place of Supply

VAT is levied at the place of supply where consumption of the products takes place. If a shop in Saudi Arabia sells a product to a customer in Saudi Arabia, the place of supply is determined to be Saudi Arabia.

However, due to the nature of some businesses the place of supply can be different.

There are some special situations:

| 1. Real Estate- (KSA based business selling products abroad) |

| 2. Telecommunications & Electronics- (KSA supply but consumed abroad) |

| 3. Culture, arts and Sports Entertainment- (Consumed abroad) |

| 4. Passenger and Goods Transport -(VAT is calculated proportionally) |

| 5. Goods supplied after import |

How VAT is paid in Saudi Arabia.

VAT tax bills must be paid by the end of the month following the month the end of the tax period. For example, for the tax period Jan 1-31st the payment is due by Feb 28th and so on.

If payments are quarterly, then for Jan 1st – March 31st, the payment is due by April 30th.

The VAT Return Form gives information about VAT collected and paid. The form is divided into two parts:

- VAT on Sales (Output VAT)

- VAT on Purchases (Input VAT)

Information related to both are entered into columns and the VAT due is automatically calculated. Payments to GAZT are done via bank transfer using the SADAD payment system.

Penalties

| Offence | Fine |

| False Documents | More than VAT value |

| Importing/Exporting goods and Non-payment | More than the VAT value |

| Failure to register on time | SR 10,000 |

| Late Filing | 5-25% of the VAT due |

| Collecting VAT without registering | Up to SR 10,000 |

| Failure to maintain books and records | Up to SR 50,000 |

| Preventing GAZT Authorities from working | Up to SR 50,000 |

| Violations of VAT Law | Up to SR 50,000 |

Related Questions

Where can businesses register for VAT payment? The GAZT website will give you step by step instructions on registrations.

How can I find out about group registrations? Two or more people can register as a group provided they are under common control meaning the same entity or individual owns 5% or more of all group members. For group applications use the GAZT application form.